trust capital gains tax rate 2021

The following are some of the specific exclusions. Capital gains taxes on assets held for a year or less.

Pets Are Big Business 4 Big Ticket Pet Stocks To Add To Your Portfolio Entrepreneur In 2022 Corgi Dog Corgi Welsh Corgi

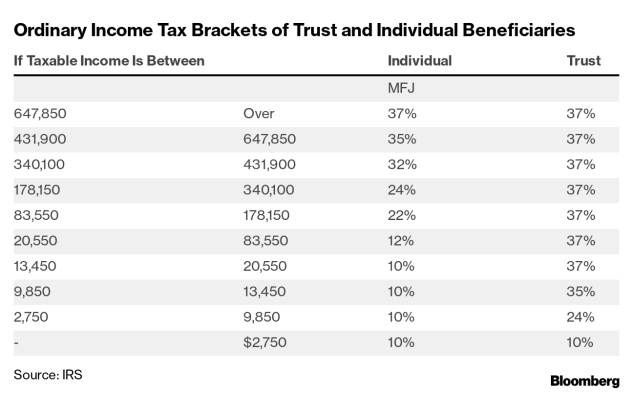

2021 Ordinary Income Trust Tax Rates.

. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. 5 days ago In 2021 and 2022 the capital. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

1 day ago Feb 24 2018 In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

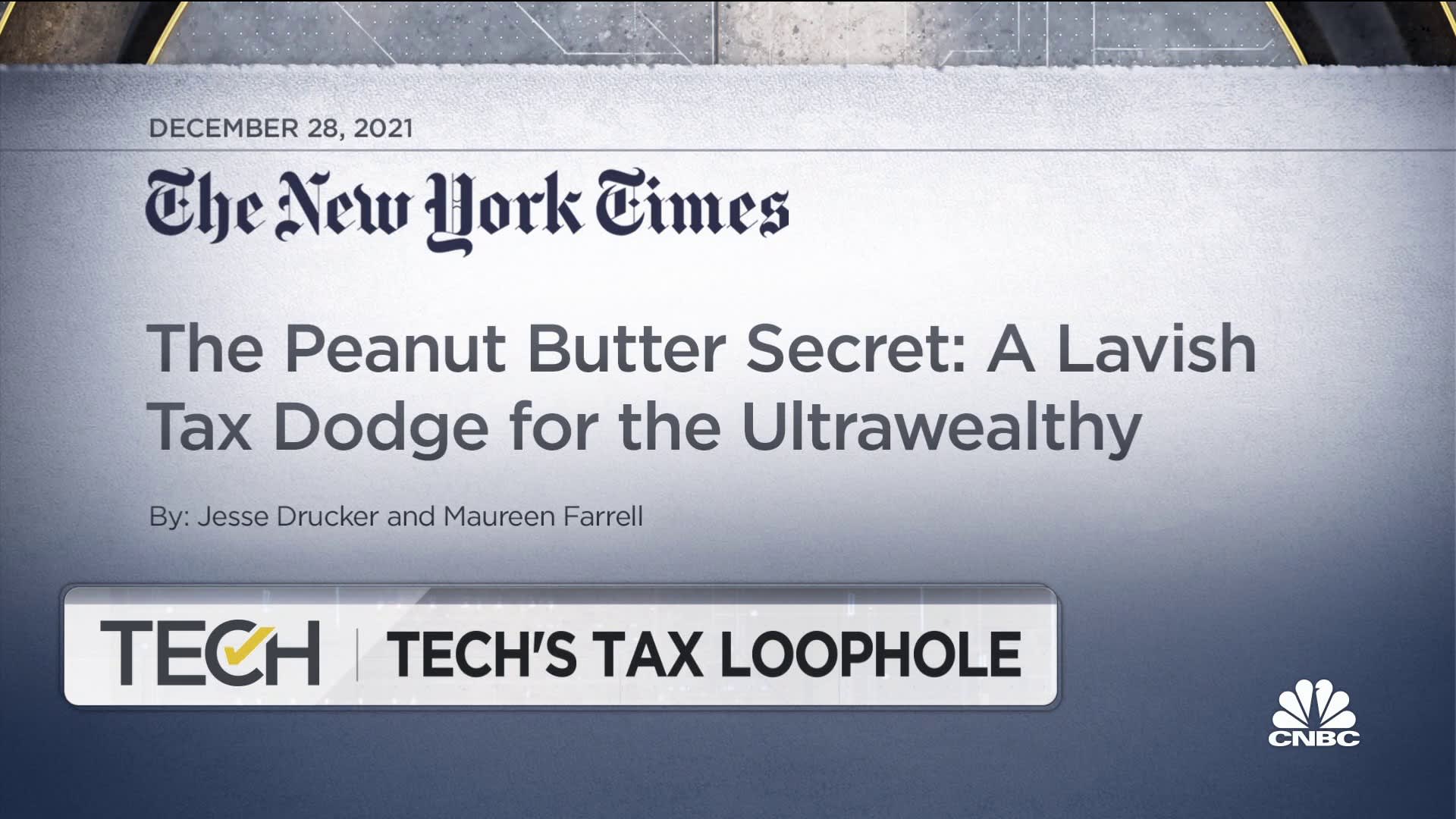

This means youll pay 30 in Capital Gains. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. Use these rates and allowances for Capital Gains Tax to work out your overall gains above your tax-free allowance.

Trust Capital Gains Tax Rate 2022 with Ingredients and Nutrition Info cooking tips and meal ideas from top chefs around the world. Trust tax rates are very high as you can see here. 2 weeks ago Feb 24 2018 In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Capital gains taxes on assets held for a year or less. The law allows up to a 500000 profit 250000 for singles tax-free if you sell your. You can find more.

Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. What is the 2021 capital gain rate. The income of the trust estate is therefore 300 100 interest income 200 capital gain and the net income of the trust is 200 100 interest income 100 net capital gain because the.

2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019. It continues to be important to obtain date of. 2021 Long-Term Capital Gains Trust Tax Rates 0.

Jul 30 2022 When stock shares or any other taxable investment assets are sold the capital gains or profits are referred to as having been realized. Senator Sanders has filed the For the 998 Act which would lower exemptions to and substantially raise the rates. They would apply to the tax return filed in.

Events that trigger a disposal include a sale donation exchange loss death and emigration. The 2020 rates and brackets for the income of an Estate or trust. Mar 23 2017 The Issue of Capital Gains.

In 2021 the federal government taxes trust income at four levels. 20 for trustees or for personal representatives of someone who. From 6 April 2020 trustees disposing of the whole or part of an interest in UK residential property have 30 days from completion to report and pay any Capital Gains Tax due.

Estate value between 35 million and 100 million 45. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. However long term capital gain generated by a trust still maxes.

Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. 2022 Long-Term Capital Gains Trust Tax Rates. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return.

The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Capital gains are the profits from the sale of a second home.

Gst Comparison In Asia To Check Out Where You Can Get The Lowest Gst Tax Rate While Travelling Or Doing Busin Tax Mistakes Savings Account Photography Business

Trust Tax Rates And Exemptions For 2022 Smartasset

Types Of Itr Forms For Ay 2021 22 Financial Literacy Form Individuality

Pioneers Are Reimagining The World Of Finance The Rewards And Risks Could Be Huge Fortune Finance Terms Of Endearment Pool Party

Pin By National Association Of Tax Pr On Tax News And Blog Posts News Blog Blog Blog Posts

Understanding Capital Gains Taxes In South Africa 2021 Capital Gains Tax Capital Gain What Is Capital

Trust Tax Rates And Exemptions For 2022 Smartasset

Trust Tax Rates And Exemptions For 2022 Smartasset

As Consumers Are Shopping Online More And More And Of Course Cybersecurity Is A Growing Concern For Shopify Shoppers Shopify Cyber Security Types Of Trusts

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Thanks To The Passage Of The Cares Act Unemployment Benefits Are Now Much Greater In Some States T Free Illustrations Make A Donation Long Term Care Insurance

How Much Should I Save For Retirement At My Age Prudential Financial Life And Health Insurance Saving For Retirement Health Insurance Policies

2021 Capital Gains Tax Rates By State

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

What Is Credit Card Insurance And Why Do You Need It Credit Card Statement Cards Credit Card

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

In This Article You Will Learn About The Simple And Effective Ways By Which You Can Estimate Your Income Tax Returns Income Tax Return Income Tax Tax Return

Pin By Bobby Cornett On Products I Had Or Was Going To Morehead